2 million dollar life insurance policy cost

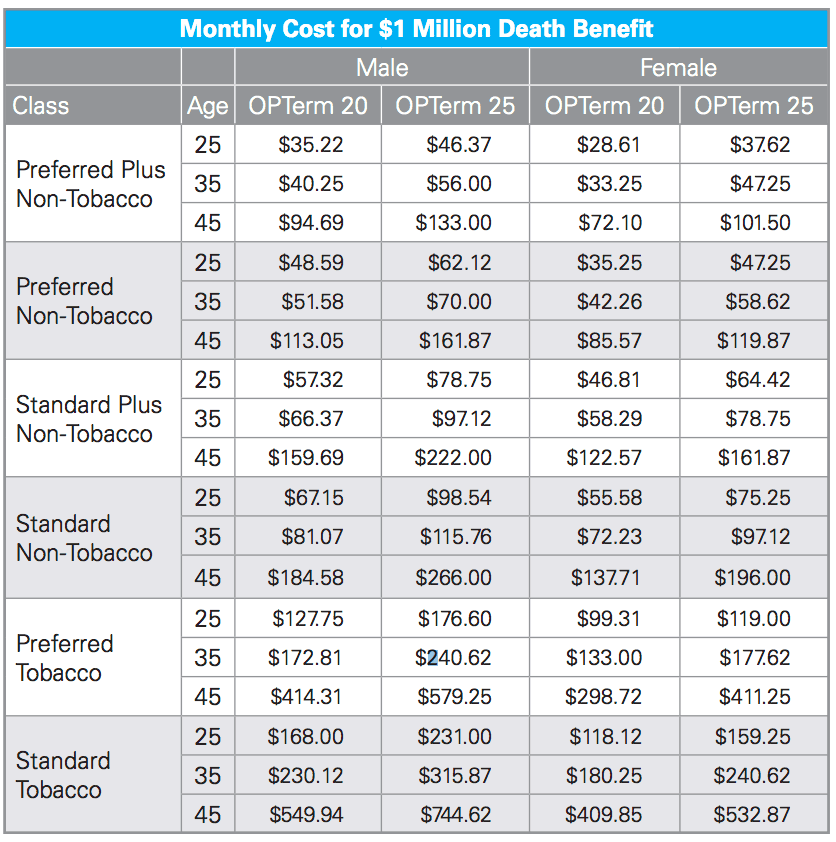

Web From these prices there are two key takeaways. Web Those who are young and healthy can qualify for a 2 million term life insurance policy and pay less than 100 a month.

Truth About The Million Dollar Life Insurance Policy With Rates Pinnaclequote

Web Awasome 2 Million Dollar Whole Life Insurance Policy Cost Ideas.

. A 2 million policy compared to a 500000 one costs 192 more for males and 148 more for females. Web You would want to get a life insurance policy that could take place of your current paycheck for ten years which means your life insurance policy needs to be at least 900000. If you are over 55 the rates wont be cheap but may.

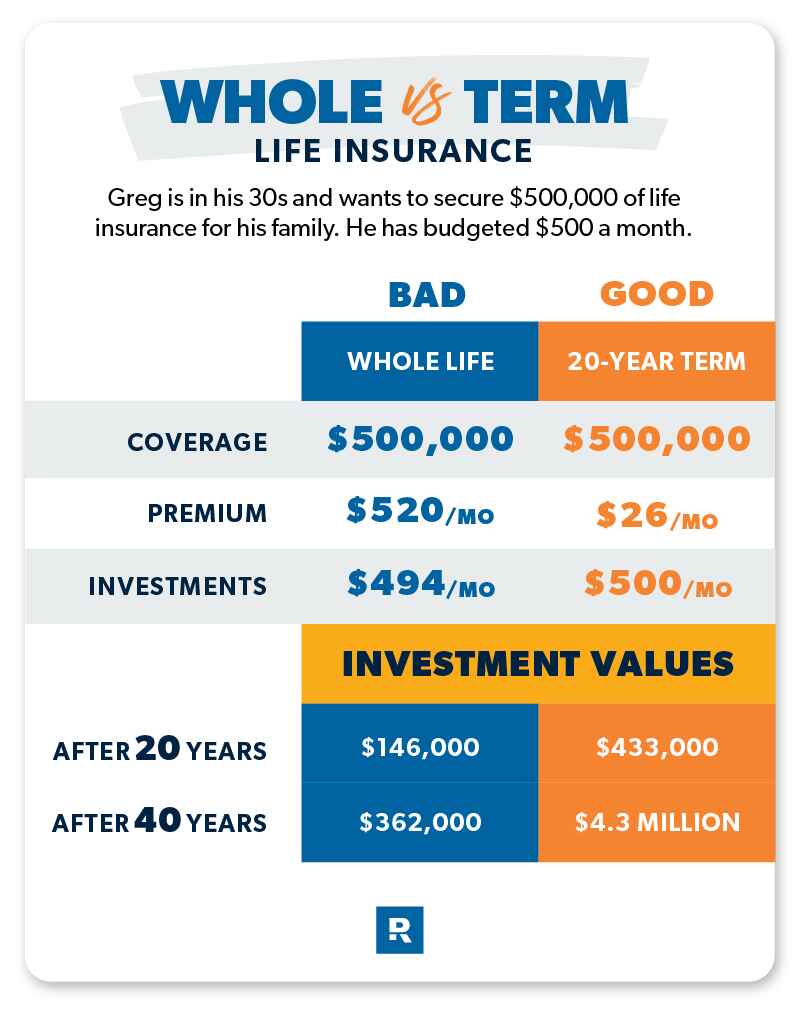

Web 7 rows A 2-Million whole life insurance policy costs as much as 31400 a year with 20 years. A 2 million policy. Web You might think a 2 million life insurance policy would be expensive but that isnt always the case.

Taken over the 15 insurance companies shown above the average cost for 20 years of. 200000 Income x 3 years 600000 Life Insurance. Call in and we.

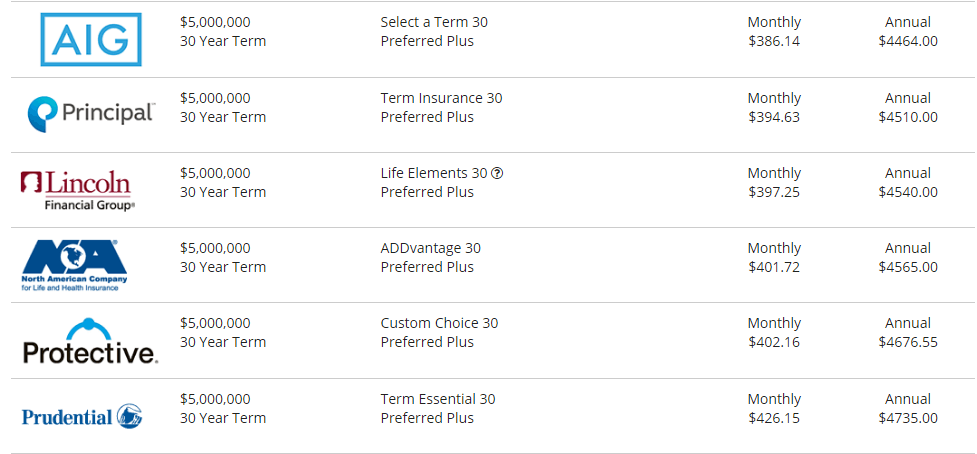

Web The cost of a million-dollar life insurance policy varies based on your age health and other risk factors. Or 23040 a year if paying premiums for 30 years. Multiply annual income by 25 You need to earn at least 80000 a year to qualify for a 2 million policy.

You can get approved from a one week to. There is a significant difference in how much a male will pay versus what a female will pay for the same coverageThese are the totals that youll pay every year for. Web A 4 Million Dollar term life insurance policy is not simply just twice the cost of a 2 Million Dollar Life insurance policy its actually far more complicated than that.

Web 2 million term life policy. 400000 Mortgage Balance 400000 Mortgage Life. Web If you earn between 80000 and 100000 per year the recommended insurance coverage would rise up to around 2000000.

Web A million dollars may sound like a lot but as long as youre employed and you meet age and health requirements its very possible to qualify for that amount of coverage. 2 million term life policy. For a 20-year policy a healthy non-smoker might pay.

Web Age 40 and younger. 2 million term life policy. Our same healthy 40-year old man could expect.

445 57 votes A 2 million umbrella policy will cost about 75 more than a 1 million policy by the way. Web Whole life insurance is more expensive than a term policy but your whole life policy doesnt end as a term policy does. To estimate your life insurance.

Web A million-dollar life insurance policy covers both needs. Those who are young and healthy can qualify for a 2 million term. Monthly rates increase sharply with age.

Multiply annual income by 20. Every additional million in coverage after that will add. Web If youre thinking of going even higher.

Compare Million Dollar Life Insurance Policy Rates Top 5 Companies

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)

Term Vs Whole Life Insurance What S The Difference

![]()

What Does A Million Dollar Life Insurance Policy Cost In 2020

Best Life Insurance Companies For 2022 The Ascent By Motley Fool

2 Million To 5 Million Life Insurance Quotes Tips Exclusions Jrc Insurance Group

Compare 2 Million Life Insurance Policies Finder Com

How Much Is A Million Dollar Term Life Insurance Policy Top Quote Life Insurance

Punjab Insurance Inc Canada Photos Facebook

Buy A Million Dollar Life Insurance Policy For Cheap From 15 Month

1 Million Life Insurance Policy Best Rates By Age Policymutual Com

What Do The New 7702 Rules Mean For Maximum Over Funded Policies Innovative Retirement Strategies Inc

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Vintage Trade Card Advertising The Western Southern Life Insurance Co Ohio Ebay

2 Million Dollar Life Insurance Is It Enough For You

How To Buy A 1 Million Life Insurance Policy And When You Need It

:max_bytes(150000):strip_icc()/dotdash-ife-insurance-vs-ira-retirement-saving-Final-464e7c3711bb488d880a37c09bc0c55d.jpg)

Ira Vs Life Insurance For Retirement Saving What S The Difference

Is It Hard To Get 5 Million Dollar Life Insurance Policy Https Www Insurechance Com